Making Sense of the FAFSA

Oct 06, 2022Let's talk about the FAFSA— or the Free Application for Federal Student Aid. The most important thing to remember is that the FAFSA for the 2023-2024 school year opens on October 1, 2022, which means that by the time you’re seeing this it should be up and running (and keep that date in mind— it opens on October 1st every year).

You will be using your 2021 tax return to complete the 2023-2024 FAFSA— and make sure that you have your spouse’s returns handy too, as well as your child’s if they had a job in the last year.

What does the FAFSA do?

The FAFSA will determine your need for financial aid based on your previous years’ tax returns.

The need based barrier is much higher than families expect. Last year, a family of four with a total family income of around $60,000 only received $448 for need based money. In addition to that, their child did qualify for the $5,500 in student loans, and $3,500 of it was subsidized, meaning the child paid no interest during their college years on that money. But $2,000 of it was unsubsidized, meaning the child was accruing interest the entire time in college. So when you look at those numbers, you realize very quickly that many people are not going to qualify for any type of need-based money.

So what's the point of filling out the FAFSA?

The point of filling out FAFSA is that you may qualify, or you will qualify, for student loans.

I personally believe that students should have skin in the game. Knowing that those student loans will come due should they decide to take a semester off, can keep them focused and on the right track. If parents would like to pay off those student loans unbeknownst to the child in advance, or cover the interest for them while they're in school, that's a great idea if you have the means to do so— but letting them feel like they have a stake in their education is important.

What your child will need to fill out the FAFSA

- Your Social Security number

- Your parents’ Social Security numbers if you are a dependent student

- Your driver’s license number (if you have one)

- Your Alien Registration number if you are not a U.S. citizen

- Federal tax information, tax documents, or tax returns, including IRS W-2 information, for you (and your spouse, if you are married), and for your parents if you are a dependent student:

- IRS Form1040

- Foreign tax return or IRS Form 1040-NR

- Tax return for Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands, the Marshall Islands, the Federated States of Micronesia, or Palau

- Records of your untaxed income, such as child support received, interest income, and veterans noneducation benefits, for you, and for your parents if you are a dependent student

- Information on cash; savings and checking account balances; investments, including stocks and bonds and real estate (but not including the home in which you live); and business and farm assets for you and for your parents if you are a dependent student

Starting the FAFSA Application

One of the things that parents need to know is that the FAFSA is filed every year, individually for each child in college. With that in mind, your child is considered an undergraduate student if they are working toward completing an associate’s or bachelor’s degree. If they are not married, do not have their own child, and are under the age of 24, they are considered dependent. They will need for you to enter your information on the FAFSA for all of the years that they still meet those criteria and require financial aid.

The FAFSA is under the child's name. It is the child's FAFSA, to which ONE parent and their spouse’s information is added, if the child is considered dependent. Even if your child goes to grad school— for example, going to medical school, getting an MBA, going to law school, anything like that— they will continue to file a FAFSA in their name only, but will no longer be dependent. They will not need parent information once they're in grad school (unless for some reason they are considered a dependent otherwise— but you will be aware of that if it’s the case).

The reason I mention this is that it's very important that you create an account with an email address and phone number that is accessible to the child. They will continue to use this for years! Do not use their high school email address! It will eventually be taken off the server, so you will lose access. You want to create the account using your child's personal email and their personal phone number, and it's really critical that your child is there with you when you're creating the account and beginning the first step.

Creating the FSAID

If it is your first time for this child, go to https://studentaid.gov/fsa-id/create-account/launch and hit get started.

The first step will be creating your child’s FSAID, which is the combination of your child’s email address, phone number, social security number, and password. It’s a lot to keep track of, so we recommend writing this information down in a safe location, and that your child be with you when you make this account.

The reason your child needs to be with you is because the government has several safety factors in place. Once you enter their email address and the child's phone number, the child will get a text message to confirm the phone number. They are also going to get an email to confirm the email address. Both of those will have pin security numbers that your child needs to enter.

While you may think, “I can outsmart this system and I can just enter my own phone number and email address”, when you eventually create your parent FSAID to sign that your information as the parent is correct on the FAFSA, they will advise that your email address is already in use and you can't get an FSAID, or that your phone number is already in used— but so is your child’s SSN, so you can’t just remake the account. You can't get an FSAID, and so now you have just created a nightmare for yourself trying to change contact information around.

Make this easy for yourself and make sure your child is with you! As a note, the FSAID pins that will come through— both text and email— are time sensitive, so don't do it while your child's at school and not immediately available. We like to refer to filling out the FAFSA as the worst family fun time of the week. It’s a bonding activity!

The Basics

You will begin the FAFSA at https://studentaid.gov/h/apply-for-aid/fafsa.

You will use the ‘Start New FAFSA’ if this is your child’s first time applying.

Enter YOUR CHILD’S FSAID. Do not enter the parents FSAID until it is time to sign the application.

The FAFSA will allow you to create a save key. The save key will allow you to exit the FAFSA, come back to it later, and pick up where you left off easily. I highly suggest a 4 number pin for your save key. Write this down!

Be careful to be accurate when filling out the basic information. Make sure everything is spelled correctly, you don’t transpose letters or numbers, and you are capitalizing correctly. This is a government form— treat it as such.

Listing Schools and Colleges

You will need to list at least one school or college that your child plans on applying to. You can list up to 10 schools in any order, and you can add or delete schools after submitting the form. These schools will not be able to see what other schools you have listed, so don’t worry about that. The order that you enter the schools does not matter.

Dependency

We addressed this above, but the FAFSA will ask a series of questions to determine your dependency status. Go through them carefully.

Parent Information

This is where things get technical.

The form will ask for financial information, including information from tax forms and current balances of savings and checking accounts. The question, “As of today, what is your balance of cash, savings, and checking accounts?” is to gauge your liquid assets. If you have mailed or submitted your $2,000 mortgage payment, but it has not cleared the bank yet, use your checkbook balance, as you no longer have that money available to you. Also note that your retirement accounts should not be lumped into savings!!! Retirement accounts are not liquid— there is a penalty to accessing that money. You should list only liquid assets in which no penalty applies to accessing the funds.

If a parent has remarried, they will ask about their spouse, even though the spouse is not the child’s parent. Often remarried parents are hesitant to disclose their new spouse’s income as the new spouses are not willing to financially support college expenses— but the government does not care if they want to support the child— it is required information in the calculation.

The IRS DATA RETRIEVAL is an excellent tool to use that minimizes the numbers you need to input from your tax return. To successfully use this tool, have your tax return available. The tool only works if your information matches IDENTICALLY. They will use the name you input on the FAFSA and the social security number to begin matching your data. But then they will ask you to input your address. It must match! Note: 123 Jones St. is NOT the same as 123 Jones Street or even 123 Jones St (without the period). Type the address exactly as it appears on your tax documents. The same holds true when using this tool for your child.

Child Information

If your child completed a tax return last year, you will need that information, as well as their cash, savings, and checking account balances. This includes any 529 accounts in their name.

Finalizing

Once all information is input into the FAFSA, your child can hit the submit button and the FAFSA will register their part as complete— but it is not submitted for review until the parent’s signature is submitted. You will use the Parent’s submit button, which will prompt you to enter ONE parent’s FSAID. Once entered, you can hit submit and the FAFSA submission is complete!

Print a copy of this information before closing out of it. Also note the SAR or EFC number provided after you submit. This number is extremely important if you would like to appeal your financial aid decision or request extra money. NOTE this now!!! It can be challenging to find this number later, and why go through the hassle.

FAFSA TIPS

- Have your child set up their FSAID using their personal email and cell phone number and have only one parent create an FSAID— it only takes one parent’s signature to submit.

- Create the FSAIDs several days in advance of filling out the FAFSA. This will eliminate any verification delays.

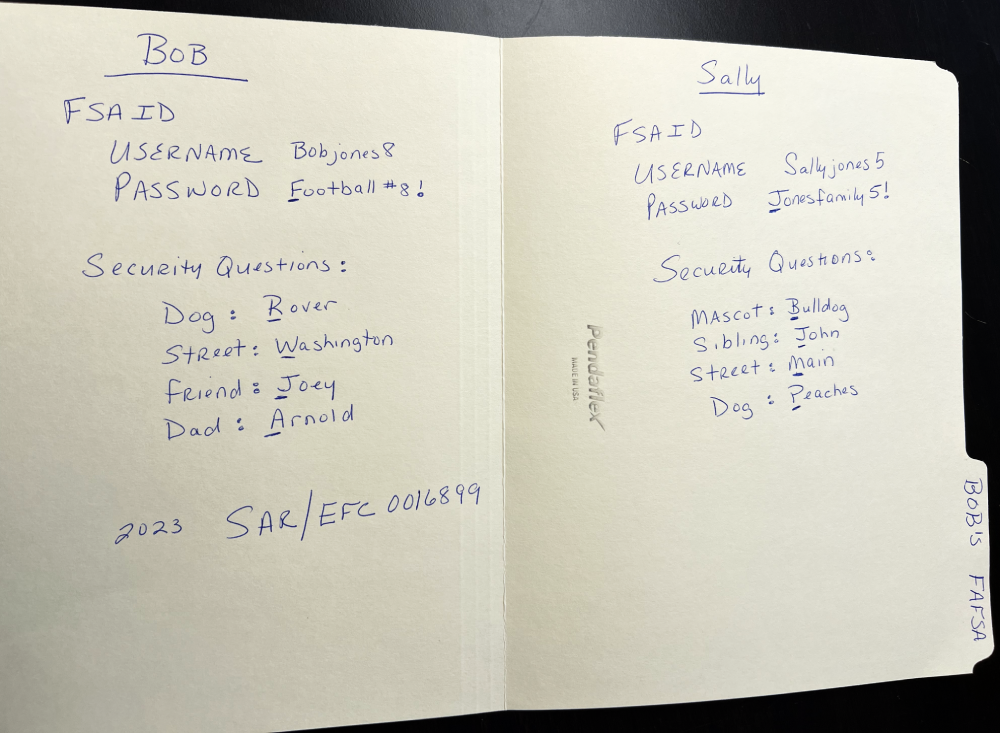

- OUR FAVORITE TIP — Use a manilla folder labeled with your Child’s Name FAFSA

- On the inside left panel record your childs:

- FSAID username and password

- All 4 security questions and answers— and use abbreviations. Trust me you won’t remember them in 4 years!

- On the inside right panel record the parent’s:

- FSAID username and password

- All 4 security questions/answers— again, use abbreviations.

See pic below — this will be a lifesaver every October for the next several years!!! And parents, if you have younger children you will be using the FSAID that you made with your first child to sign their FAFSA as well.

If you are wondering which parent you should use to complete the FAFSA, refer to this link. It is great information.

https://studentaid.gov/apply-for-aid/fafsa/filling-out/parent-info

If you have further questions about the college application process and would like to schedule a consultation, click here to schedule a FREE 15-minute consultation.